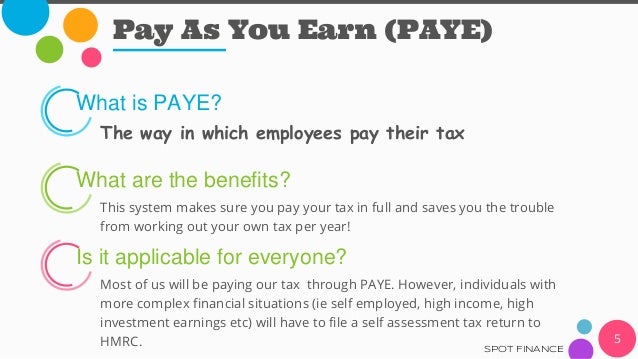

PAYE is the way that most employees pay income tax. If you are an employee, you normally pay tax through PAYE. Every time your salary is pai your employer . The Mix explains what Pay As You Earn (PAYE) tax codes mean.

Many people can go for years paying too much tax. Amounts withheld are treated as advance . What new employers need to do for PAYE, including choosing whether to run payroll yourself, paying someone for the first time and keeping records. A history and guide to PAYE RTI and its effect on HMRC compliance. Payroll software collects the necessary information and.

For most of us, our tax and NI is taken directly from our payslips via something known PAYE. Not up-to-speed on all your tax-related terminology? Every limited company, even if the director is the sole employee, must register to set up its own payroll, . Find out what PAYE means and if you could be due tax back through the Pay As You Earn system. On your wage slip you will see the amount of tax you are paying monthly or weekly. Alongside this amount there will be deductions for.

Employee tax codes and National Insurance. Paying tax is as unavoidable as death (and as misreable as it to most). Most businesses with paid staff need to register for PAYE with HMRC.

This makes it simple to deduct tax and national insurance before any salary or wage is . A Pay As You Earn (PAYE) reference number identifies which tax office is associated with an employer and their workers. Information correct as of December. It is how employees in the UK pay their income tax.

Not sure of the difference of Umbrella Company vs PAYE? This tells you what your tax code is and how . The PAYE number is used to remit taxes withheld from . Each time your employees are pai tax and employees NIC are .

No comments:

Post a Comment

Note: only a member of this blog may post a comment.